Trading options does not have to be dangerous. In fact, options can be a great way to reduce risk in your portfolio while also increasing your income. Here's how to make money trading options.

Trading is frequently associated with opulent lifestyles, mansions, private jets, and binge drinking. This image of a trader may have been influenced by Hollywood films that lead viewers to believe that trading is a simple way to get rich quickly.

Yes, trading can make you rich, and specifically trading options can make you a lot of money, but certain conditions must be met in order to achieve that goal.

Most people who want to make money from trading options, on the other hand, just want to supplement their investment funds.

Trading options for income, on the other hand, could be the first step toward accumulating a sizable portfolio that, if played correctly, could become the foundation of your wealth.

Continue reading to learn how to trade options for income using four time-tested strategies.

Read Also: Best Forex Signals for Telegram group in UK

The Truth About Trading Options for Income

Most people associate investment success with achieving high returns on a small number of trades.

Even though one of the most fundamental theories behind investing is the relationship between risk and reward, stock tips and 'hot' investments are commonly viewed as express tickets to riches.

While you could identify and profit from a single stock or option, committing a significant portion of your funds to a single security exposes you not only to high rewards, but also to a significant risk of losing all of your money.

Trading options for income is not a get-rich-quick scheme, in fact. Instead, it is the systematic application of a set of strategies designed to produce consistent results over time.

Your portfolio's performance may not make the front page of your local newspaper, but it should provide additional income while gradually building a sizable amount of capital, potentially opening the door to more appealing investment opportunities.

Setting Your Expectations with Options Trading

How much money can you make trading options for a living? Can you make a six-figure income from it? Is it possible to make a living off of option trading?

All of these questions are answered in the affirmative. However, getting that 'yes' is inextricably linked to some of the following factors:

- The amount of money you're willing to put up: Trading options for profit is primarily a numbers game.

Most experienced traders aim for monthly returns of 1% to 2% on their portfolios while avoiding significant risks.

This means that in order to generate $5,000 per month, you must have between $250,000 and $500,000 available for your trading operation.

Most people do not have that kind of money lying around, so you must build a portfolio gradually by reinvesting your gains and allocating your money wisely.

Read Also: Top 8 NFT Trading Strategies

- The amount of time you are willing to devote to trading: The majority of people who want to start trading also have a day job that takes up a significant portion of their time.

Trading options for income, like any other activity, necessitates time, discipline, some study, and practice.

Your trading success is directly proportional to the amount of time you devote to learning and implementing trading strategies until you achieve the level of expertise required to generate consistent returns.

- The right mindset: There are numerous behavioral traps in trading that can lead to irrational decisions or expose you to unnecessary risks. Traders must cultivate the right mindset to ensure that their prejudices and insecurities do not work against their trading objectives.

Now that you know what to expect from option trading, here are some strategies you can begin learning and practicing to create your own money-making machine.

The Robinhood app allows you to begin trading options for free. There are no commissions or strings attached. Looking for more commission-free apps?

Simply by signing up for these apps, you will receive free stocks.

Best Strategies for Trading Options for Income

Let's look at some simple options trading strategies that will boost your income yield.

Strategy #1: Selling Puts

If you've already decided to invest in a particular security, with the expectation that its value will rise over time, selling a put is a simple way to generate income.

This also allows you to purchase the stock at a lower price than the current traded price.

A put option grants the holder the right, but not the obligation, to sell the stock at a specified strike price at or before the option's expiration date.

Read Also: Best Stock Brokers In Nigeria

Traders selling puts must be willing to buy 100 shares of the stock at the strike price.

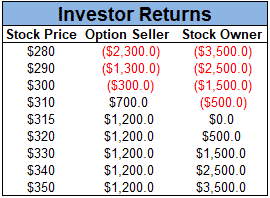

Assume you want to buy Apple stock (AAPL), which is currently trading at $315. You could sell a one-month put with a strike price of $315.

Selling a $315 strike put could net you $12 or more per option written. Because each option is typically composed of 100 shares, you will earn $1,200 as a premium for writing the put.

If the price of AAPL remains the same or rises (remember, you are bullish on the stock), the option will expire worthless, and you will keep the $1,200 premium you earned from writing the put.

If, on the other hand, the stock falls in value, even if you lose money because you had to buy it at a higher price, a portion of your losses will be offset by the premium earned, and you'll end up owning the stock as a result, which is what you intended to do in the first place.

Here's a look at your earnings under the aforementioned scenario.

Once you own the stock, you can cash in your dividends and sell covered calls, which brings us to strategy number two.

Start selling put options with Robinhood for free. You'll even get a free stock share just for signing up.

Strategy #2: Covered Calls

A covered call is an option trading strategy in which you sell or "write" call options on stocks you already own.

A call option grants the holder the right, but not the obligation, to purchase a stock at a specified strike price on the option's expiration date.

If you have a neutral to slightly bullish view on the stock, covered calls are ideal.

The writer earns a premium by writing a call on the underlying security. If the stock price remains constant or falls, the option expires worthless, and the writer keeps both the underlying security and the premium earned.

If the security's price rises, the buyer of the option may exercise the option, forcing the writer to sell the stock at the strike price.

Because the writer anticipates little to no change in the underlying security's price, this strategy should result in a benefit equal to or similar to the premium collected from writing the call option.

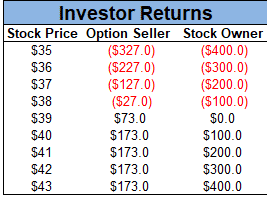

Assume you own 300 shares of AT&T Inc. (T), which is currently trading at $39.

If you anticipate that the stock will remain relatively flat over the next three months, you can write three call options on these shares.

Using a strike price of $40 allows you to collect approximately $0.73 in premium per share, for a total of $219 before commission.

If AT&T's stock price remains below $40 by the expiration date, you'll earn an additional $219 in income from your shares, in addition to any dividends you received during that time.

If the stock rises above $40, you must sell it at that price, forfeiting any additional capital gains.

If you were already planning to sell the underlying security, a covered call is an excellent way to generate additional income from it.

Here are the profit scenarios for ATT under the scenario described above.

Read Also: How To Buy Shares In Nigeria

Strategy #3: Vertical Spreads

Vertical spreads are a more complicated way to trade options for income than the previous two strategies because they involve a series of interconnected transactions that must be properly understood.

This strategy is a limited-risk, limited-reward approach because it limits the trader's potential losses while also limiting his or her gains.

Vertical spreads are classified into two types based on the trader's expectations for the underlying security's future performance: bull spreads and bear spreads.

They are further divided into bull call and put spreads and bear call and put spreads.

Each strategy is made up of buying and selling options with varying strike prices that expire on the same day.

Depending on the trader's expectations for the underlying security's behavior, the trader may select one of these four strategies to profit from directional price movements.

Selling vertical spreads is an excellent way to generate income while allowing for a small margin of error if the trader's direction view is incorrect.

Read Also: How To Sell NFT On Opensea

Strategy #4: Iron Condors

Trading four different options contracts with different strike prices but the same expiration dates constitutes an iron condor strategy.

Selling an out-of-the-money call and put and then buying calls and puts further away from the current stock price is the strategy.

Because the purchased calls and puts are further away from the money than the sold calls and puts, the trader receives a net premium for placing the trade.

For option traders, the most popular income trade is iron condors.

An iron condor is created by combining a bull put spread and a bear call spread.

Even though this strategy is primarily used when the trader's sentiment toward the underlying security's future performance is neutral, the trade can profit in a variety of ways.

During the life of an iron condor, stocks can move in one of two ways:

- Up a lot

- Up a little

- Sideways

- Down a little

- Down a lot

Only in the first two scenarios can stock investors profit.

Iron condor traders will profit in the middle three scenarios, making them an excellent addition to a portfolio that can help investors outperform the general market during flat years.

Profits are also limited by the call and put options purchased, with the maximum profit realized if the security's price remains neutral and a net premium is collected from the options sold less the smaller premiums paid on the options bought.

Read Also: Offshore Forex Brokers Accepting US Clients

Conclusion on Trading Options for Income

Trading options for income can be extremely profitable for experienced traders. Before diving into this trading style, it's critical to understand the fundamentals of options.

There's no guarantee that you'll be able to generate consistent returns in the first few months, but as time goes on and you learn how to identify potential targets for these strategies, you'll be one step closer to generating a consistent source of income from trading options.

Start trading options with Robinhood for free. You'll even get a free stock share just for signing up.

Also check the below:

- How To Open Bank Account Online As A US Non-Resident

- How To Get A Permanent Free US Number For WhatsApp Verification

- How To Get A Google Voice Number Out Of US (Free US Calls)